When it comes to buying a property in Singapore, ECs (executive condos) are the go-to for Singaporeans whose income exceed the income ceiling for HDB flats but who still find private condominiums too costly. If you are setting your eyes on an EC, it is then imperative to know the differences between a new EC and a resale EC in order to make an informed purchase.

A resale EC brings many advantages such as being nearer to full privatisation and having no MOP (Minimum Occupation Period), but may come at a higher cost (not eligible for CPF housing grants). There are also differences between resale ECs of different ages; an EC that is five years old or less can only be sold to Singaporeans and Permanent Residents while an EC in its eleventh year or more can be sold to everyone including foreigners and companies.

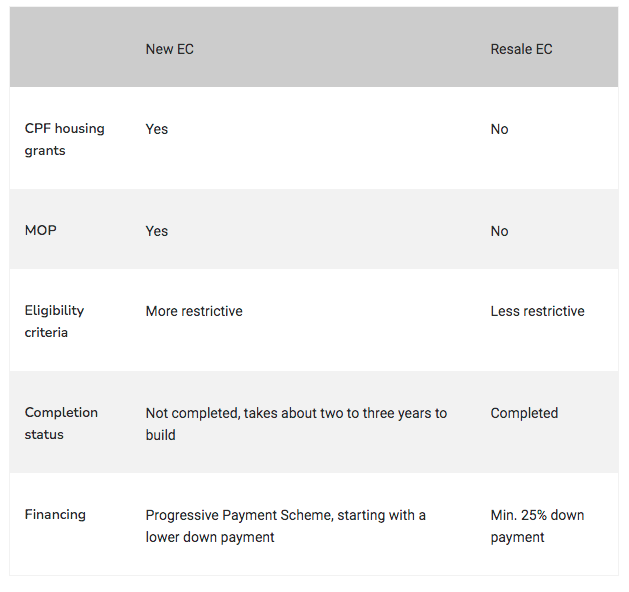

What are the Differences Between a New EC and a Resale EC?

1. CPF Housing Grants

Buyers of new ECs can consider two CPF Housing Grants, namely the Family Grant and the Half-Housing Grant (you and any co-applicants must be eligible at the point of booking the EC). The Family Grant goes up to $30,000 while the Half-Housing Grant goes up to $15,000.

A key thing to note is that you have to be a first-timer applicant who does not own an HDB flat and must not have received any other forms of housing subsidy, among other conditions. On the other hand, buyers of resale ECs are not entitled to any grants, as such ECs are regarded as private housing. This may increase the comparative price of resale ECs significantly.

2. MOP (Minimum Occupation Period) and Privatisation

A main draw of ECs is that they fully privatise after 10 years, which means the pool of buyers increase to include foreigners. Buyers of a new EC will have to wait out the MOP (Minimum Occupation Period) period of five years to sell it to Singapore Citizens and Permanent Residents, and a full 10 years before selling to foreign buyers. Buying a resale from a first owner automatically guarantees that it would be in its 6th year or more, which means you can already start to sell or rent to the same group of buyers (Singapore Citizens and Permanent Residents) even before full privatisation.

If you already own an existing HDB flat, you cannot buy a new EC and keep that HDB as ECs are under HDB rules. The only option is to sell your existing flat six months before receiving the keys to the EC if you really want the more premium residence. However, if you buy an EC that has finished serving its MOP of five years, or is already fully private, you can still keep your old flat. However, in that instance, ABSD for owning two properties will apply.

3. Eligibility

It is easier to be eligible for resale ECs than new ECs.

There are a number of conditions to meet in order to buy a new EC. Most notably, your household income cannot exceed $16,000. Other key criteria include the condition that at least one other applicant must be a Singapore citizen or Singapore Permanent Resident (if more than one person is applying), and the need to qualify for the EC under one of four eligibility schemes.

For a resale EC that has served its 5-year MOP, the buyer has to be a Singapore Citizen or Singapore PR in order to buy the EC in its 6th to 10th year occupation period, but need not conform to any of the four schemes stated above. From the 11th year onwards, all restrictions will be lifted, opening the sale of the EC to foreigners and corporations.

4. Completion status

Perhaps the biggest and most important difference in a new vs resale EC is their completion status. When you buy a new EC at launch, there is a waiting time of two to three years before the development reaches TOP. On the other hand, resale ECs (well, all resale properties, really) are already built and ready for move-in. If you need a place urgently, you may not have the luxury of time to wait years for a new EC to be completed.

Additionally, when buying completed properties such as resale ECs, you can properly inspect the unit for physical defects to make sure the conditions meet your standard before committing to the purchase. This is unlike buying new launches, where you can only make the in-person inspection after the construction is complete.

Although these new properties are brand new and should be in flawless condition, construction defects do happen, and depending on the severity, may be troublesome to rectify.

Even if repairs are possible and paid for by the developer, delays can be costly if it interferes with your quality of life or rentability. If you are buying a resale EC to stay in, you can also inspect in real-time whether the neighbourhood is to your liking in terms of noise or traffic level.

5. Financing

ECs – new or not – are not eligible for HDB housing loans, so you will need to get a bank loan. There is, however, a difference in the type of bank loan you should get and the payment schedule.

As mentioned, new ECs are usually uncompleted properties, also known as Buildings Under Construction, or BUC. BUC properties are usually financed with BUC loans that follow the Progressive Payment Scheme (PPS), which starts out with a lower down payment that slowly increases as the development reaches certain ‘milestones’ in its construction.

For resale ECs, however, you will need to get a ‘regular’ bank loan which requires at least 25% down payment. The difference in the upfront payment is significant and your cash and/or CPF savings may limit your choice.

When Should You Consider A Resale EC?

As mentioned above, a resale EC has many advantages over a new EC: It is closer to full privatisation, has less restrictive eligibility criteria, offers you the option to keep your old HDB flat, and is usually move-in ready. On the flip side, it can be more expensive as there are no CPF housing grants for resale ECs.

Certain advantages like being closer to full privatisation may be less important for owner-occupiers, and more important to investors. After all, most only consider access to a larger pool of buyers as a boon if there are intentions to sell, whether now or in future. Likewise, the less restrictive eligibility requirements may appeal to buyers who are determined to invest but cannot buy a new EC as they already own an HDB flat.

For families who intend to upgrade to an EC, a new EC seems preferable as there is not yet a rush to sell, and eligible buyers can take advantage of CPF housing grants to lower costs.

Here’s who we think should consider buying a resale EC:

- You want to invest and maximise rental yield and income by renting or selling to a large pool of buyers including foreigners

- You are buying a resale EC for your own stay and want to move in as soon as possible

- You already own an HDB flat and thus cannot buy a new EC, but want to own a new private property

Source: https://www.propertyguru.com.sg/property-guides/pgf-new-vs-resale-ec-39491?utm_source=braze&utm_medium=edm&utm_campaign=sg-pg-consumer-newsletter-nlcc-enga-edm-weeklynews-20210108&utm_content=active—hero-btn

This article was written by Ali Musak.